Compliance Narratives

13.1 - Financial Resources

Judgment of Compliance

Narrative

Sam Houston State University (SHSU) has sound financial resources and a demonstrated, stable financial base to support the mission [1] of the institution and the scope of its programs and services. SHSU is a member of the Texas State University System (TSUS) “under the management and control of the Board of Regents, Texas State University System” as specified in the Texas Education Code, Chapter 96.61 [2].

Institutional Audit

As an agency of the State of Texas, SHSU is included annually in a statewide single audit [3] [4] [5]. In addition to the annual State of Texas Statewide Audit, SHSU also has an internal audit function that reports directly to the Board of Regents [6]. The system-wide internal audit function is coordinated through the System Director of Audits and Analysis, who reports directly to the Finance and Audit Committee of the TSUS Board of Regents. The mission of the Audits and Analysis office includes the following:

- Providing the Board of Regents, Chancellor, TSUS executives, and component management with independent, objective evaluations regarding enterprise-wide risk management activities, internal controls, compliance, and governance processes.

- Enhancing, system-wide, overall awareness of the importance of risk assessment, control, compliance, and governance processes.

- Protecting organizational value by providing risk-based and objective assurance, advice, and insight.

- Ensuring that the system-wide internal audit function complies with the Institute of Internal Auditors’ International Standards for the Professional Practice of Internal Auditing and the Texas Internal Auditing Act.

Financial Position and Reporting

The Vice President for Finance and Operations has designated the University Controller as the financial reporting officer who is responsible for the integrity of the Annual Financial Report (AFR) and for the establishment of effective internal controls for its preparation. SHSU’s AFRs for fiscal years 2014 [7], 2015 [8], 2016 [9], and 2017 [10] have been prepared in accordance with Government Accounting Standards Board requirements and in accordance with SHSU policy [11], TSUS policies [12] on AFR preparation, and with the Texas State Comptroller of Public Accounts’ Reporting Requirements for Annual Financial Reports of State Agencies and Universities [13]. The AFR is submitted annually to the TSUS Office and is included in the combined TSUS AFR. That report is then submitted to the Comptroller of the State of Texas and is included in the Consolidated Annual Financial Report (CAFR) for the State of Texas. SHSU has provided a Financial Statement Analysis as of August 31, 2017 [14].

The financial history of SHSU displays financial stability through The Statement of Change in Unrestricted Net Position, Exclusive of Plant [15]. Additionally, this statement shows that SHSU is investing in the operations of an expanding university.

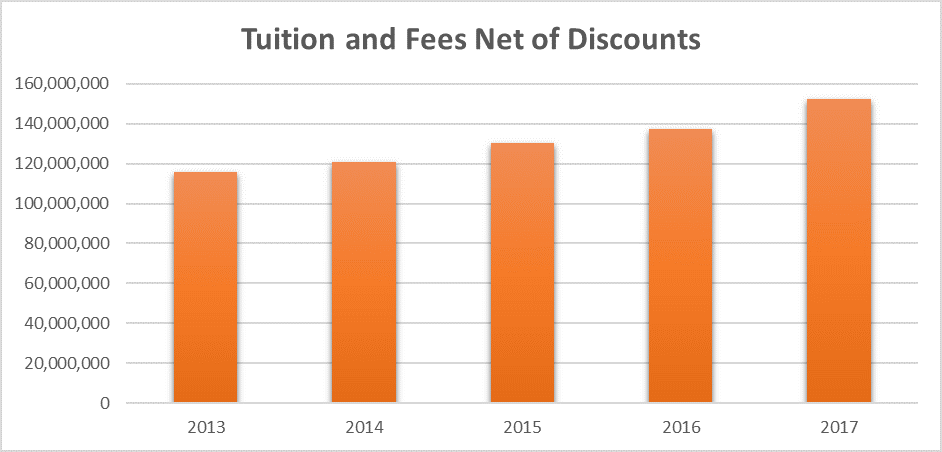

As another indication of financial stability, SHSU’s tuition and fee collections from 2014 through 2017 show a solid increase each year. The increases are a function of increases in hourly fee rates as well as increases in the student population. These increases are documented in Figure 1.

Figure1. Tuition and Fees Net of Discounts – 2013-2017

Endowment Funds and Capital Campaigns

The University’s first capital campaign closed on August 30, 2010, and surpassed the $50 million goal with more than $61 million in gifts and commitments secured. Since that time, over $87 million has been contributed to SHSU, including an annual average of $16 million from 11,500 donors and 25,000 gifts during the past three years.

In 2014 SHSU began preparing for the second capital campaign in its history. This process included a thorough feasibility survey and the implementation of a “quiet phase” solicitation of the University’s best supporters. The University formally kicked off the $125 million “Honoring Traditions. Creating Futures.” campaign on January 28, 2017, with $85 million having been obtained in contributions, pledges, and expectancies.

As of August 2018, $105 million in gifts, pledges, and expectancies had been received for the “Honoring Traditions. Creating Futures.” campaign. Donors have made gifts for construction projects, program start-up, academic enrichment, scholarship endowments, and faculty support. The TSUS Board of Regents authorizes each of its component institutions’ presidents to establish the requirements for a new endowment account. SHSU has established $25,000 as the minimum amount required from a donor to establish an endowment. The development staff encourages donors to create endowments at the $50,000 level. Donors can attain an endowment minimum by pledging gifts over a period of five years.

Other than financial and investment policies and procedures that are established and reviewed by the TSUS Board of Regents, a system-wide policy does not exist specifically for the expenditure of gifts. Donors may designate their gifts to target areas. A written agreement executed by the donor(s) and one or more representatives of the University governs endowments. These agreements are maintained by the Development Office, and copies are held by the appropriate SHSU departments. These agreements specify the use of the endowment’s earnings, including the reinvestment of a portion back into the endowment’s corpus. The SHSU Vice President for Finance and Operations has strict oversight of the corpus of the endowments, which cannot be expended.

The funds are infused into the strategic plan, which will further expand students’ educational experience and encompass the President’s three broad-based initiatives: (a) upgrading academic standards, (b) expanding and improving facilities, and (c) enhancing the visibility and image of the University while maintaining its very special culture and character. This infusion of funding into the University demonstrates a strong financial position and financial stability now and in the future.

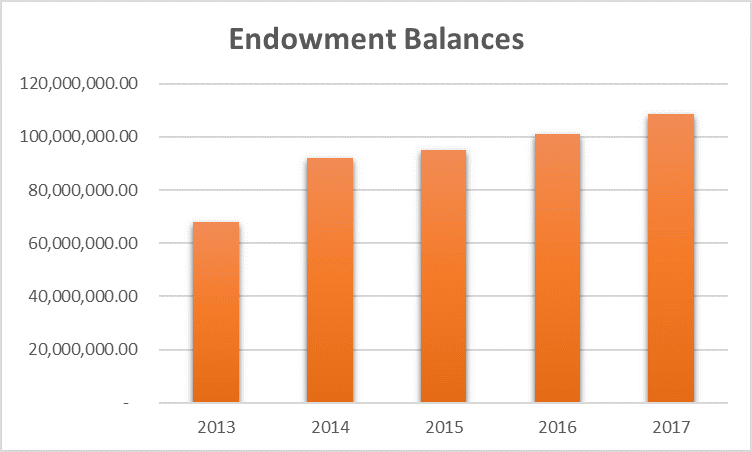

The success the capital campaign and the graph below further demonstrate the financial stability of SHSU. Figure 2 illustrates the increases in endowment balances from fiscal years 2013 through 2017.

Figure 2. University Endowment Balances – 2013-2017

Annual Budget

A more detailed description of SHSU’s annual budget process is described in Standard 13.2; however, a brief overview of the budget process is provided here.

Legislative Appropriation Process – Educational & General

The Texas State Legislature meets in regular session every other year. The first legislative bill introduced each regular session is the appropriation bill for the next biennium for all State of Texas agencies. Detailed instructions for developing the biennium legislative request are received from the Texas Legislative Budget Board (LBB). A copy of the letter received pertaining to biennium fiscal year 2018 and fiscal year 2019 is provided for review [16]. The legislative request contains formula-driven appropriations based on a variety of inputs (e.g., semester credit hours [SCH], headcount, square footage, appraisal values) for “Instruction and Operations” and “Infrastructure” (physical plant, grounds, custodial and purchased utilities). Non-formula and Non-Formula Support appropriations are also requested utilizing the LBB instructions. The instructions for the current biennium (fiscal year 2018 and fiscal year 2019) asked for only non-formula and special item requests. The formula items are determined by the LBB following instructions from the Lieutenant Governor and Speaker of the House.

Copies of three biennium summaries of Legislative Appropriation Requests for fiscal years 2012-2013, 2014-2015, 2016-2017, and 2018-2019 are provided [17] [18] [19] [20].

Categories of Legislative Appropriations – Educational and General

The major categories of the appropriation for SHSU are as follows:

- Formula-Instruction/Operations – Uses SCH in the formula for Operations and Support.

- Non-Formula – Instruction/Operations

- Teaching Experience Supplement

- Staff Group Insurance Premiums

- Worker’s Compensation

- Texas Public Education Grants

- Organized Activities – University Farm

- Excellence Funding

- Infrastructure Support – Formula

- Educational & General Space Support

- Tuition Revenue Bond Retirement – Non Formula-Infrastructure Support

- Non-Formula Support

- Academic Enrichment Center

- Allied Health Programs

- Sam Houston Museum

- Business & Economic Development Center

- Law Enforcement Management Institute

- Correctional Management Institute

- Crime Victims Institute

- Environmental Studies Institute

- Institutional Enhancement

- Comprehensive Research Fund

Posting of Appropriations

The Office of the State of Texas Comptroller posts the appropriations passed by legislature in a timely manner. Funds are available for utilization by the Agency on the first day of September of each year. The posting of appropriations are receivables for SHSU, and this posting is recorded in a timely manner by the Texas Comptroller. The posting of appropriations provides the funds for the operational “bottom line” for SHSU’s educational budget. SHSU’s biennial appropriations for fiscal years 2012-2013, 2014-2015, 2016-2017, and 2018-2019 are provided [21] [22] [23] [24].

Capital Appropriations – Higher Education Assistance Fund (HEAF)

In 1986 the Texas Constitution was amended by voters to establish the Higher Education Assistance Funds (HEAF). The fund, $100 million per year, provides monies for capital improvements to SHSU and other institutions not eligible for Permanent University Fund disbursements. HEAF monies may be spent only for Educational and General capital equipment, major renovation and repair, new construction, real estate acquisition and library books, and periodicals and binding.

SHSU received $17,329,858 for fiscal year 2018 in HEAF funding. The approved budget for fiscal year 2018 is as follows:

| Capital Equipment – Academics | $ 1,100,306.00 |

| Repair and Renovations | $ 0.00 |

| Computer Services | $ 1,300,000.00 |

| Library | $ 42,000.00 |

| Major Repairs and Renovations | $ 8,000,000.00 |

| Capital Equipment – President | $ 0.00 |

| Capital Equipment – VP-Academic Affairs & Graduate Studies | $ 742,694.00 |

| Capital Equipment – VP-Student Services | $ 0.00 |

| Capital Equipment – VP-Advancement | $ 16,650.00 |

| Capital Equipment – VP-Enrollment Management | $ 33,453.00 |

| Capital Equipment – Texas Research Institute for Environmental Studies | $ 115,000.00 |

| Capital Equipment – Finance & Operations | $ 5,979,755.00 |

The HEAF funds and proceeds from new construction bonds provide sufficient funding to offset depreciation expense.

Institutional Debt – SHSU

All debt of SHSU is held by the TSUS. The bonded indebtedness by TSUS for SHSU as of August 31, 2017, was as follows:

| Tuition Revenue Bonds (TRB) | |

| Series 2008 Performing Arts Center | $ 414,750.00 |

| Series 2008 Refunding ref 98a TRB | $ 190,973.24 |

| Series 2010 Refunding TRB | $ 5,941,880.68 |

| Series 2012 Refunding 2002 Farrington | $ 161,720.91 |

| Series 2015A Refunding 2005 Property Infrastructure | $ 312,650.10 |

| Series 2015A Refunding 2008 Performing Arts Center | $ 5,049,150.00 |

| Series 2017A Bio Lab | $ 55,292,486.62 |

| Series 2017A Refunding 2008 Performing Arts Center | $ 1,437,304.82 |

| Non-Tuition Revenue Bonds (NONTRB) | |

| Series 2008 Academic Building | $ 693,000.00 |

| Series 2008 Performing Arts Center | $ 1,149,750.00 |

| Series 2008 Refunding 98a NONTRB | $ 1,361.06 |

| Series 2009 Dining Facility | $ 295,750.00 |

| Series 2010 Refunding 2002 Baseball/Softball | $ 1,276,869.23 |

| Series 2010 Refunding 2002 Bearkat Village | $ 4,453,841.49 |

| Series 2010 Refunding 2002 Business Annex #1 | $ 1,276,869.23 |

| Series 2010 Refunding 2002 Business Annex #2 | $ 319,217.31 |

| Series 2010 Refunding 2002 Parking | $ 1,428,877.47 |

| Series 2010 Refunding 2002 Rec Sports | $ 2,067,312.09 |

| Series 2010 Refunding 2003 Baseball/Softball #2 | $ 425,623.08 |

| Series 2010 Refunding 2003 Business Annex #3 | $ 319,217.31 |

| Series 2010 Refunding 2003 Sam Houston Village | $ 3,632,996.98 |

| Series 2010A Residence Hall | $ 24,263,493.94 |

| Series 2011 The Woodlands University Center | $ 38,979,162.60 |

| Series 2012 Refunding 2002 Ag | $ 11,508.84 |

| Series 2012 Refunding 2002 Athletic | $ 46,002.28 |

| Series 2012 Refunding 2002 Business Bldg. | $ 46,002.28 |

| Series 2012 Refunding 2002 Farrington | $ 1,930.00 |

| Series 2012 Refunding 2002 Housing | $ 159,858.08 |

| Series 2012 Refunding 2002 Parking | $ 51,755.26 |

| Series 2012 Refunding 2002 Sports | $ 74,761.24 |

| Series 2012 Refunding 2003 Business | $ 329,799.82 |

| Series 2012 Refunding 2003 Housing | $ 3,677,399.91 |

| Series 2012 Refunding 2003 Softball | $ 424,515.03 |

| Series 2012 Turf Install | $ 1,009,368.78 |

| Series 2013 Sycamore Vivarium | $ 1,477,300.00 |

| Series 2013 University Camp | $ 3,964,100.00 |

| Series 2014 Advising and Counseling Center | $ 9,381,650.00 |

| Series 2015A Pirkle | $ 14,738,943.92 |

| Series 2015A Refunding 2005 | $ 2,094,141.06 |

| Series 2015A Refunding 2005 Housing Facility | $ 9,033,315.46 |

| Series 2015A Refunding 2008 Academic Building | $ 8,670,300.00 |

| Series 2015A Refunding 2008 Performing Arts Center | $ 14,444,700.00 |

| Series 2015A South. Res. Complex | $ 96,902,618.92 |

| Series 2015B Pirkle | $ 3,848,810.56 |

| Series 2015B South Dining Hall | $ 6,416,085.44 |

| Series 2017A Coliseum | $ 13,955,000.00 |

| Series 2017A Refunding 2008 Academic Building | $ 2,416,250.00 |

| Series 2017A Refunding 2008 Performing Arts Center | $ 4,025,056.90 |

| Series 2017A Refunding 2009 Dining Facility | $ 2,440,250.00 |

| Series 2017B Financial Plaza | $ 7,568,306.22 |

| Total Debt Service | $ 356,593,988.16 |

Total Revenue and Percentage of Revenue Provided By State of Texas Appropriation

The sources of revenue for SHSU’s fiscal budget year 2018 are as follows:

| Educational and General Funds | % of Total | ||

| State Appropriation | (75.81%) | $ 97,034,358 | |

| Tuition and Fees | (24.19%) | $ 30,956,883 | |

| Total Appropriated Funds | $ 127,991,241 | 36.38% | |

| Auxiliary Enterprises Funds | $ 71,635,378 | 20.36% | |

| Designated Funds | $ 152,144,736 | 43.25% | |

| Total Estimated Revenues | $ 351,771,355 | 100% |

The percentage of funding by legislative appropriation has decreased steadily for the past ten years. The locally collected designated tuition and fees per semester credit hour (SCH) has increased from $84/SCH in fiscal year 2008 to $165.50/SCH for fiscal year 2018. The revenues from designated tuition and other fees have provided needed monies to provide additional faculty salaries and needed new academic space to meet the 27% increase in enrollments at SHSU over this same time period. These trends have provided financial stability.

Preparation of the Budget

The budget is prepared with inputs from the Council of Academic Deans, vice presidents, Director of Budget, and the President’s Cabinet and is consistent with the SHSU Mission [1], Master Plan [25], Strategic Plan [26], and TSUS Board of Regents guidelines [27]. The SHSU Budget Procedures and Guidelines [28] hold preparers and users to high financial responsibility to ensure financial stability and good stewardship of public funds.

The budget draft is presented to the SHSU President and subsequently to the TSUS Board of Regents for approval prior to the beginning of the fiscal year. Included are SHSU Budgets for fiscal years 2015 [29], 2016 [30], 2017 [31], and 2018 [32].

Budget Summaries

Annually, the TSUS Board of Regents receives a Budget Summary when the budget for the upcoming year is submitted for approval [33] [34] [35] [36]. These summaries demonstrate that SHSU is financially stable and provides good stewardship of all funds.

Bond Rating

The TSUS bond rating is another indicator of financial stability at SHSU. The current rating is Aa3 (Moody’s) and A+ (S&P). SHSU bonds are issued through TSUS and held in the name of the System. However, SHSU is responsible for principal and interest payments through transfers to the System, where payments are disbursed. These payments are made from a combination of funds appropriated by the Texas State Legislature and from funds held on campus that are collected in student fees.

Educational Expansion and Campus Growth

Due to the stability of financial resources at SHSU, the campus has been able to support expansion of educational programs and campus infrastructure, to include the addition and expansion of numerous campus buildings.

The University has also directed sufficient funding to maintain a sufficient number of full-time faculty and reduce its student-to-faculty ratio. SHSU’s SCH production increased from 229,673 in academic year 2014 to 248,902 in fall 2017, an increase of 8.37% [37]. During this same time period, SHSU’s full-time faculty equivalents increased from 811.37 to 914.26, an increase of 12.68%, and its student-to-faculty ratio decreased from 24 to 1 to 21 to 1 [38]. During this same time period, SHSU developed new degree programs to include four new doctoral degree programs, seven new master’s degree programs, and four new bachelor’s degree programs [39]. In addition, in each of the past five years, SHSU has provided its faculty and staff either merit advances in salary or one-time merit bonuses ranging between two and three percent of annual salary.

In alignment with SHSU’s Master Plan [25], since September 2017 SHSU has constructed or purchased seven facilities totaling over 160,000 gross square feet (GSF) at a cost of approximately $67 million, inclusive of the Life Sciences Building, Natural History and Art Gallery, and the Gibbs Ranch Conference Center. Currently under construction are two additional facilities, the Art Complex and the Steele Golf Facility, totaling approximately 74,000 GSF with a current budget of roughly $37.8 million. To enhance the University’s existing facilities, SHSU has completed renovations of over 40,000 GSF in two facilities at a cost of approximately $8.9 million since September 2017 and is currently renovating 11,300 GSF of the Lowman Student Center, with an additional expansion of 79,000 GSF, with a total budget of $44.4 million. Additional infrastructure projects completed since September 2017 include the West Plant Renovation and the Bowers Boulevard Resurface for a total cost of approximately $2.1 million. Infrastructure projects currently in progress include the East Plan Expansion and the Bowers Boulevard Utilities and Town Creek Drainage with a current budget of over $12 million.